The new dividend tax rules, as announced by George Osborne during the Summer 2015 Budget presentation, are proving to be difficult for most people to comprehend. There are a lot of “thresholds” and “tax rates” being mentioned, but no actual illustration to show exactly what this means to you as a small business owner. We would like to take this opportunity to help make it clearer for you.

Currently dividends that are paid out of a limited company to the shareholders are deemed to be net of a 10% tax credit. This means that when the 10% dividends tax is applied to their income tax calculation (for basic rate taxpayers), the tax is already deemed to have been paid through the company, and hence there is no additional tax to pay. This is also referred to as the “effective rate of tax”. The effective rate of tax on dividends under the current legislation is 0% for basic rate taxpayers and 25% for higher rate tax payers. This is why a lot of self employed individuals choose to operate under a limited company instead of remaining a sole trader.

Under the new legislation the first £5,000 of dividend income will be tax free, with the income falling into the basic rate band being taxed at 7.5% and income falling into the higher rate band being taxed at 32.5%. Another big change is that dividends will no longer be regarded as being net of a 10% tax credit.

So what does all this means in terms of your liability to income tax? Let us illustrate:

Example Scenario

Mr Brown owns 100% of the share capital in his business Brown and Co Limited. He awards himself a salary each year of £8,000 and then tops up his income with dividends.

1) Basic rate tax band

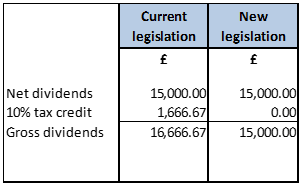

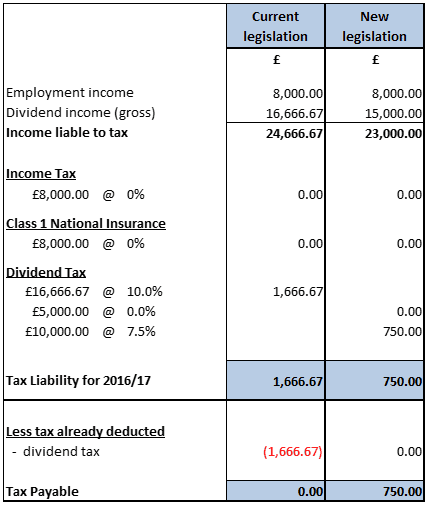

In this example Brown and Co Limited has awarded Mr Brown £15,000 in dividend income, in addition to his £8,000 salary.

As you can see from the calculations below, under the current legislation Mr Brown’s income tax liability is £1,666.67. However, since the dividends are deemed to have been paid net of a 10% tax credit, Mr Brown does not have to physically pay any money over to HMRC.

Under the new legislation Mr Brown’s income tax liability would be £750. Since the dividends no longer carry the 10% tax credit, Mr Brown will be liable to pay HMRC the entire £750.

2) Higher rate tax band

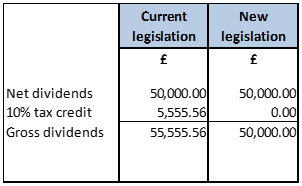

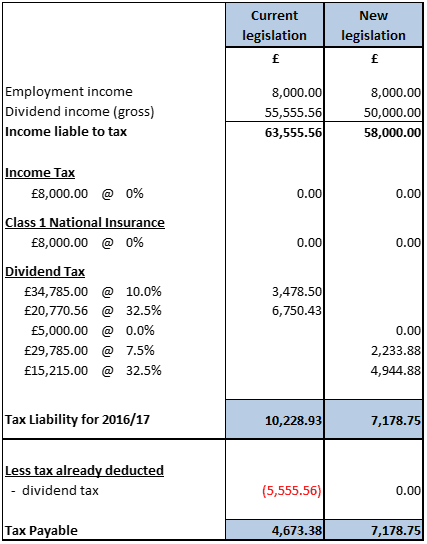

In this example Brown and Co Limited has awarded Mr Brown £50,000 in dividend income, in addition to his £8,000 salary.

As you can see from the calculations below, under the current legislation Mr Brown’s income tax liability is £10,228.93. Since the £50,000 dividends were paid net of a 10% tax credit, this is deducted from his liability to show the amount payable to HMRC as being £4,673.38.

Under the new legislation Mr Brown’s income tax liability would be £7,178.75. Since the dividends no longer carry the 10% tax credit, Mr Brown will be liable to pay HMRC the entire £7,178.75.

These changes to the system brings into question the age old debate……is it better to be a sole trader or a limited company?

Using the examples above as a basis for comparison, a sole trade with profits of £23,000 would be liable to income tax and class 4 national insurance of £3,744.60, whilst a sole trade with profits of £58,000 would be liable for £15,872.55.

It is therefore reasonable to conclude that in the majority of cases being a limited company can provide better tax benefits than operating as a sole trade, even though the savings have now been slightly reduced in light of this new legislation.