The new tax year is right around the corner, and with each new tax year comes new tax rules and thresholds. The most publicised of the changes happening in the 2016/17 tax year is the change in the tax treatment of dividends. This article will outline exactly what this change will mean to the money that ends up in your pocket, and how the new rules might not be as bad as they first seemed.

In order to demonstrate clearly the difference between the old and the new legislation I will be using the 2016/17 thresholds across all of my calculations. These are:

| Personal allowance | £11,000 |

| Basic rate limit | £32,000 |

| Higher rate threshold | £43,000 |

What are the legislation changes?

From April 2016 the dividend tax credit of 10% will be replaced by a tax-free dividend allowance of £5,000. The rate of tax on dividends is also changing as illustrated below:

|

|

Old rate |

New rate |

|

Basic rate band |

10% |

7.5% |

|

Higher rate band |

32.5% |

32.5% |

|

Additional rate band |

37.5% |

38.1% |

What is the 10% tax credit?

Under the current legislation, all money taken from a limited company in the form of dividends is deemed to be taken NET of a 10% tax credit.

In monetary terms this means that if you were to draw £30,000 in cash from your company during the year (as dividends), then actual dividend income stated on your self assessment tax return would be £33,333.33.

In the same way that an employee gets paid net of tax, you as a company shareholder get paid dividends net of tax too….you just may not have realised it until now.

From April 2016 this tax credit concept will be removed, and all dividend drawings made from a limited company will be deemed to be made GROSS.

Payment of tax

Changing the tax status of company dividend drawings from net to gross is a significant change that will impact all small business owners. The concept of the 10% tax credit was created to offset the 10% dividend tax charge, and inevitably meant that no physical cash had to be paid to HMRC. The new rules mean that business owners will now have to physically pay HMRC for the tax due on their dividends.

Therein lies the reason why this tax change is getting so much media attention.

Example : The reality for your pocket

The most tax efficient set up for small business owners has always been to award a small salary of approx £8k (in order to be below the national insurance threshold) and then to top up their income with dividends as much as the higher rate threshold would allow.

For now I am going to maintain the £8k salary and focus on the tax change for dividends.

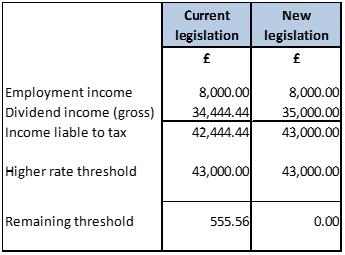

Step 1) Basic rate band

In order to utilise the basic rate band in the 2016/17 tax year, company drawings would need to be as follows:

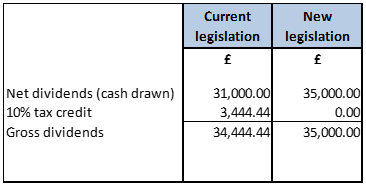

Step 2) Company drawings

In order to achieve the gross dividends as shown above, the company owners could physically draw cash in the following amounts:

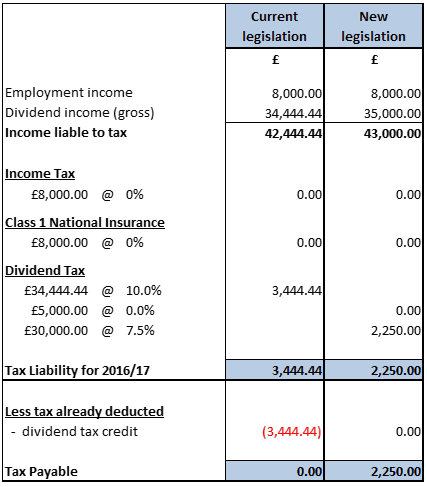

Step 3) Income tax calculation

Now we can see the difference the new legislation makes to the income tax calculation.

The tax charge has actually reduced, but the amount physically payable has increased.

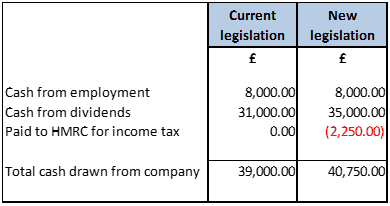

Step 4) The reality for your pocket

Finally we can put all this information together to show how the new rules affect the money in your pocket.

Even after the dividend tax has been paid to HMRC, business owners will find themselves £1,750 better off under the new legislations.

Conclusion

When George Osborne first stated the proposed change to dividend tax rules in July 2015, the announcement was met with uproar and confusion. No-one quite understood how it would affect them and if the change was something to be celebrated or reproached.

Although the change initially appeared to be bad news for small business owners, it is clear from the calculations that the change is actually a good thing for them. Even though they now have a tax bill at the end of the year, they can now extract more cash from their companies without crossing the higher rate threshold.